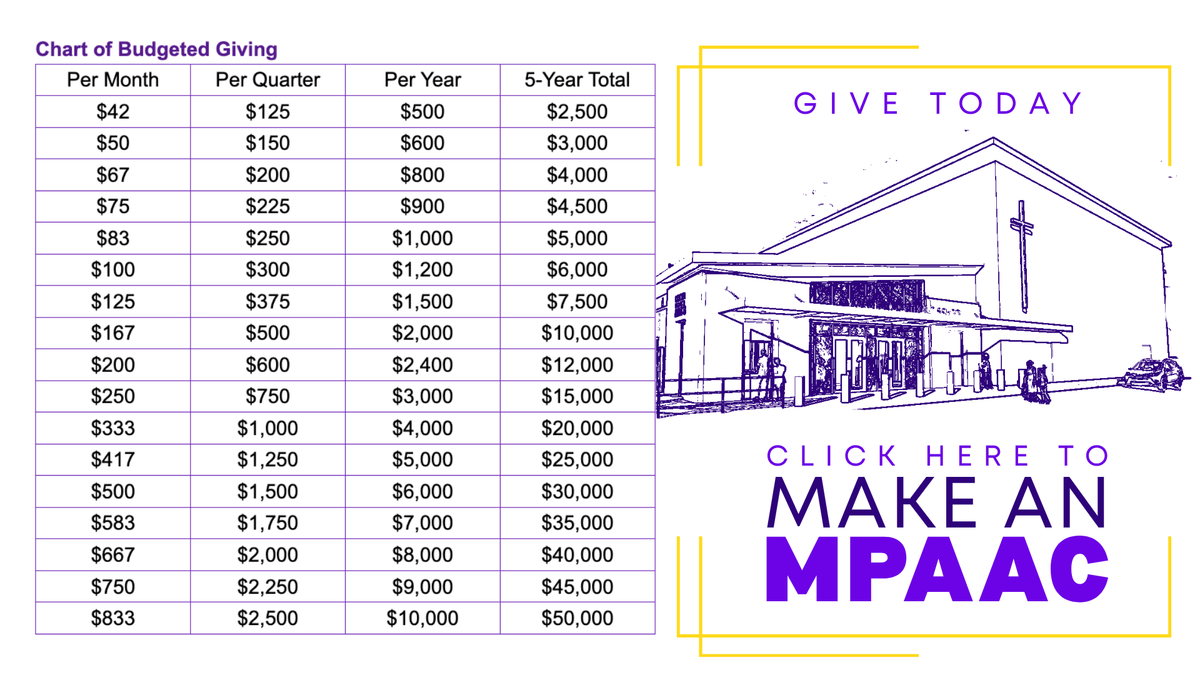

Make an MPAAC

Our middle and high school programs continue to thrive:

- More than half of our students in grades 7–12 performed in the high school musical The Little Mermaid.

- Our athletic program is flourishing with 26 varsity sports, including new additions like women’s volleyball and archery, offering every student the opportunity to grow and excel both in and out of the classroom.

We have now reached a pivotal point: we need the space and infrastructure to match our vision.

Last summer, as part of a transformational $10 million comprehensive campaign, we completed renovations of our lower and upper school buildings.

Now, as we move into the next phase, we have begun construction on a Multi-purpose Performing Arts and Athletic Complex — the centerpiece of our campus expansion.

With your help, we will create a space that meets the diverse needs of our students and community.

The Complex Will Provide:

- A Modern Performance Hall and Auditorium

For student musicals, assemblies, graduations, award ceremonies, and Mass — events that currently must be held off-site - Indoor Athletic Space

Multi-sports athletic training and year-round physical education - Multi-Purpose Facilities

Designed to accommodate athletic training, competitions, large gatherings, and community events - A Dedicated Space Uniting Arts, Athletics, and Academics

Reinforcing our commitment to developing the whole child

MORE THAN A BUILDING

This is not just a building — it is a launchpad for the future.

The new complex will relieve pressure on our current gym and cafeteria, provide essential room for expanded enrollment, and allow us to continue offering excellence in education without compromise.

.

.

WAYS TO GIVE to Vicksburg Catholic School

Cash – The simplest way to support Vicksburg Catholic School is through cash gifts. This form of giving makes an immediate impact and is fully tax deductible.

Securities – Long-term appreciated stocks and other securities may be transferred to Vicksburg Catholic School. The donor may avoid capital gains taxes upon sale of the stock and be able to claim a charitable deduction.

IRA Charitable Rollover – Individuals age 70½ and older can donate up to $100,000 each year from their IRAs to Vicksburg Catholic School tax-free. Donors do not receive an income tax charitable deduction., however his provision allows donors to transfer money from their IRAs directly to a qualified charity without having to recognize the transfer as taxable income.

Real Estate – Gifts of real estate can include a personal residence, a vacation home, a farm or ranch, income-producing rental property or undeveloped land. Depending on the value of the real estate, the donor may be able to realize a charitable tax deduction and also avoid capital gains taxes.

Bequests – A bequest through a will is the most common form of planned giving. This is an attractive option for donors who wish to retain control of their assets during their lifetime and assist Vicksburg Catholic School at a future date. Bequests may designate a specific dollar amount, a percentage, or the residual of an estate after taxes, expenses and family needs are met. Important estate tax savings may be realized through this type of gift.

Life Insurance – An individual may contribute a paid-up life insurance policy, buy a new policy, or contribute an existing policy to Vicksburg Catholic School. In addition, a donor may add Vicksburg Catholic School as a partial beneficiary to an existing policy. The donor may benefit from an immediate tax dedu Dashboard ction or other more complex tax benefits, depending on how the insurance is given.

Retained Life Estate – An individual may donate real estate while retaining the full use and enjoyment of the property. Vicksburg Catholic School assumes possession of the property at the end of the donor’s or the surviving beneficiary’s lifetime. The donor may benefit from an immediate income tax deduction as well as future estate tax savings.

Retirement Plan and IRA Designations – A donor may designate that Vicksburg Catholic School receive any remaining assets from an IRA or other qualified pension or profit-sharing plan. The donor maintains access to funds throughout his/her lifetime, and later gifts are deducted from their taxable estate. This may provide considerable tax savings to the donor’s heirs.

Charitable Lead Trust – Lead trusts are usually created for a term of years within which Vicksburg Catholic School receives income. At the end of the trust period, the principal is passed on to the donor’s heirs.